Case Study of NPCI BBPS Biller Dashboard

Case Study of NPCI BBPS Biller Dashboard

Case Study of NPCI BBPS Biller Dashboard

This work complies an NDA.

This work complies an NDA.

Globally Launched Video

Globally Launched Video

Globally Launched Video

Globally Launched Video

Business Context

1.1 A brief of what it tried to solve

Users at the customer end many times face challenges and frustration when money gets debited from the account using any COU app but bill payment is not done.

"Here's the simplest and most effective way to tell the story of the two banks and explain the problem they're facing."

Users at the customer end many times face challenges and frustration when money gets debited from the account using any COU app but bill payment is not done.

"Here's the simplest and most effective way to tell the story of the two banks and explain the problem they're facing."

Business Context

1.1 A brief of what it tried to solve

Users at the customer end many times face challenges and frustration when money gets debited from the account using any COU app but bill payment is not done.

"Here's the simplest and most effective way to tell the story of the two banks and explain the problem they're facing."

Business Context

1.1 A brief of what it tried to solve

Users at the customer end many times face challenges and frustration when money gets debited from the account using any COU app but bill payment is not done.

Here is the best way possible story of the two banks depicting the problem statement:

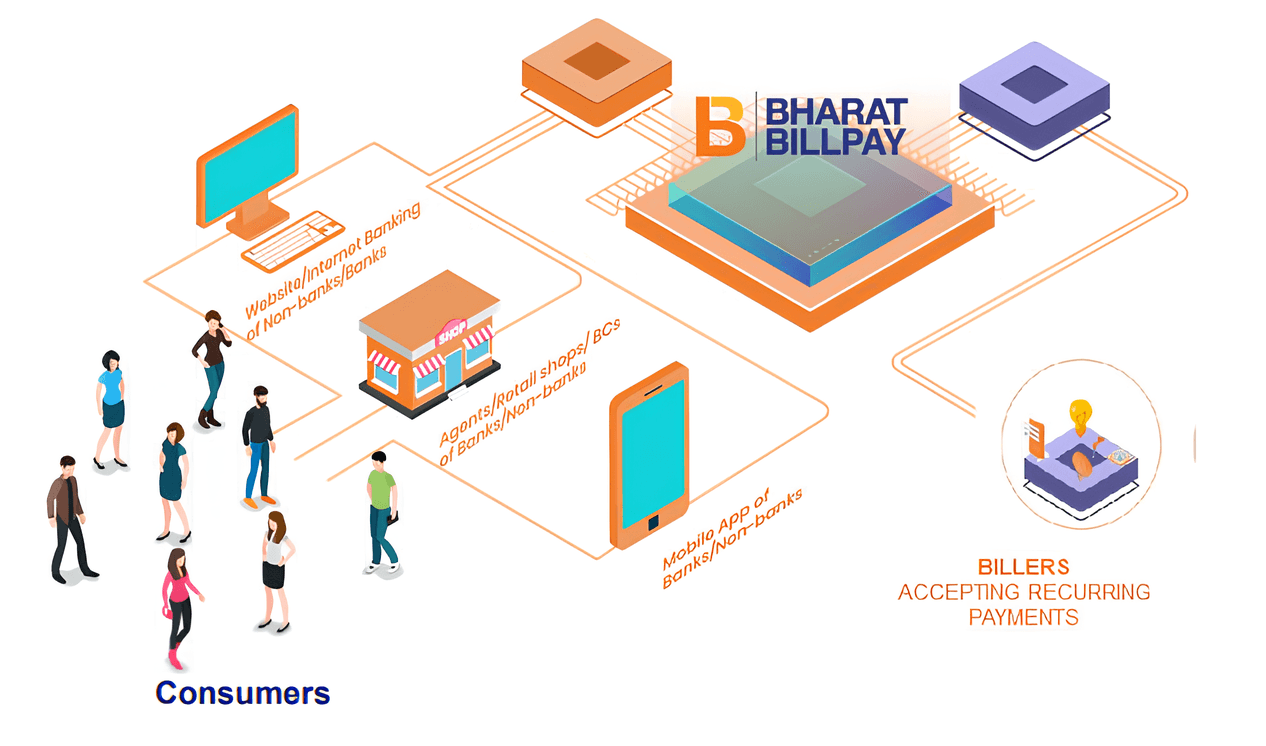

1.2 Let's grasp the functioning of BBPS here

1.2 Let's grasp the functioning of BBPS here

1.2 Let's grasp the functioning of BBPS here

Bharat BillPay is an ecosystem that provides one-stop interoperable bill payment solution for recurring payments and enables the consumers of banks and non-banks across India to make bill payment via their preferred mode of channel like: Mobile App, Mobile Banking, Website/Pre-login, Internet Banking, ATM, KIOSK Physical centres like Agent, Bank-Branch, Business Correspondents

Bharat BillPay is an ecosystem that provides one-stop interoperable bill payment solution for recurring payments and enables the consumers of banks and non-banks across India to make bill payment via their preferred mode of channel like: Mobile App, Mobile Banking, Website/Pre-login, Internet Banking, ATM, KIOSK Physical centres like Agent, Bank-Branch, Business Correspondents

Bharat BillPay is an ecosystem that provides one-stop interoperable bill payment solution for recurring payments and enables the consumers of banks and non-banks across India to make bill payment via their preferred mode of channel like: Mobile App, Mobile Banking, Website/Pre-login, Internet Banking, ATM, KIOSK Physical centres like Agent, Bank-Branch, Business Correspondents

Users at the customer end many times face challenges and frustration when money gets debited from the account using any COU app but bill payment is not done.

Here is the best way possible story of the two banks depicting the problem statement:

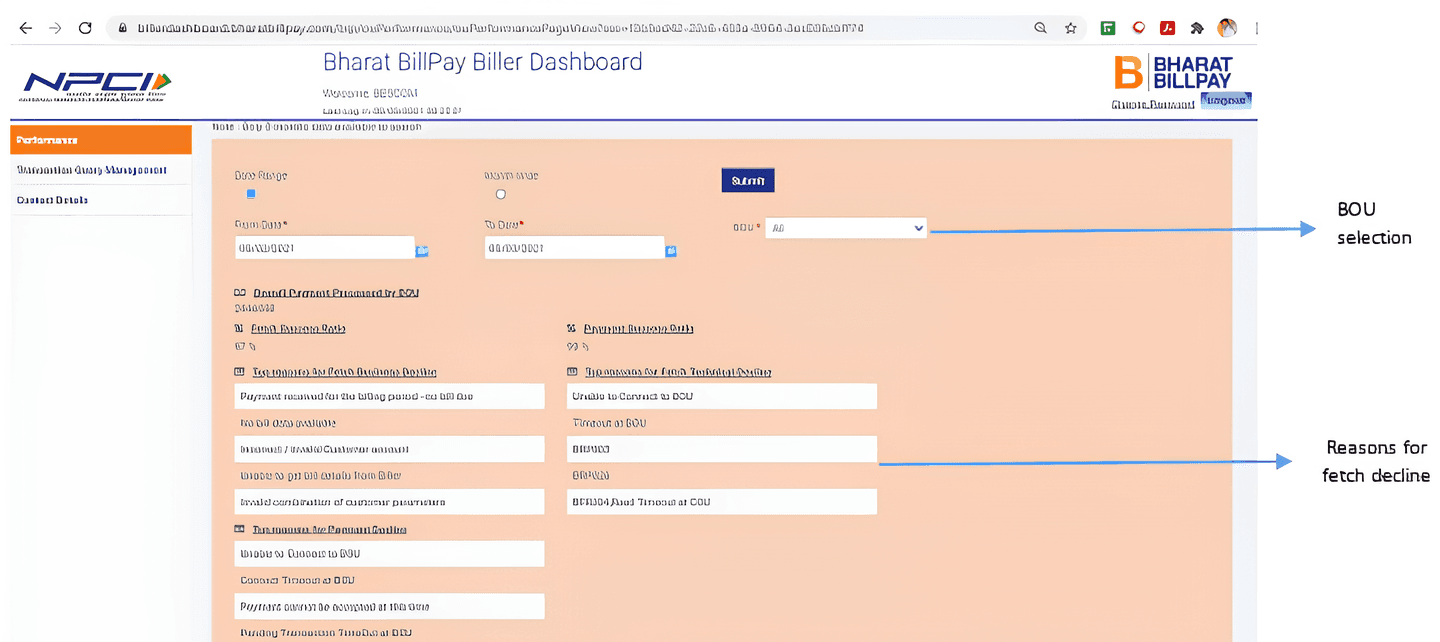

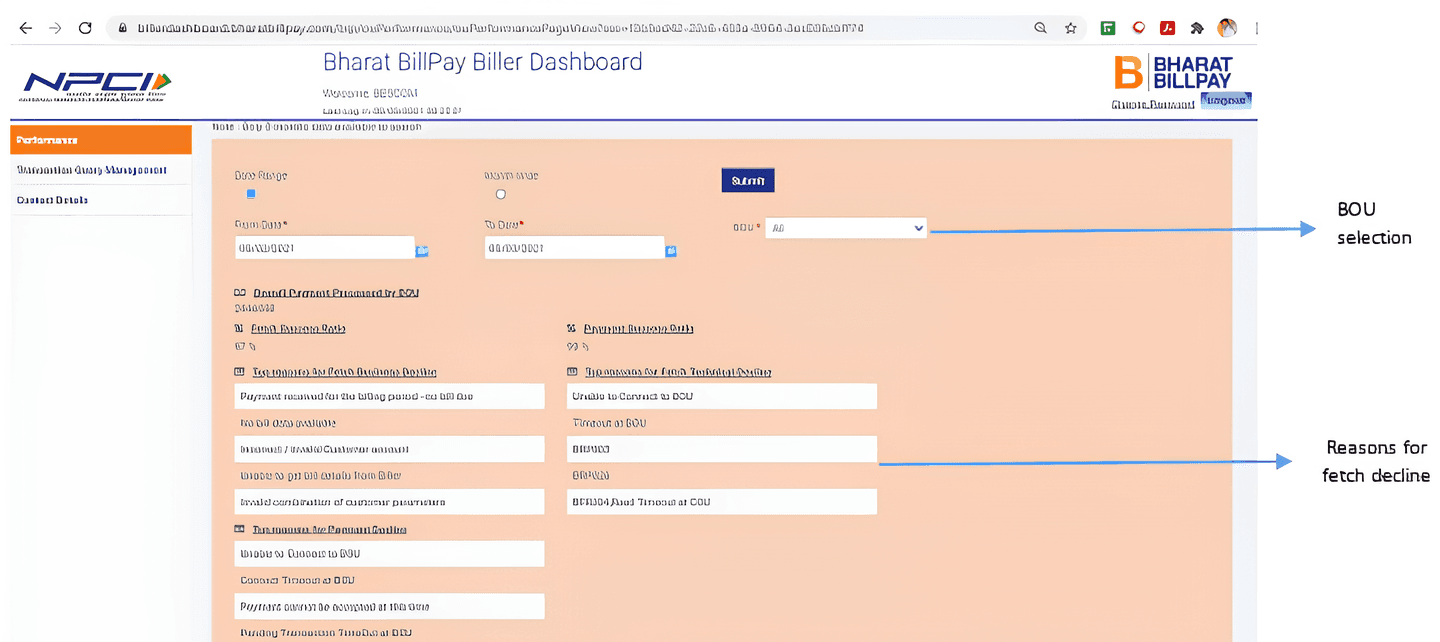

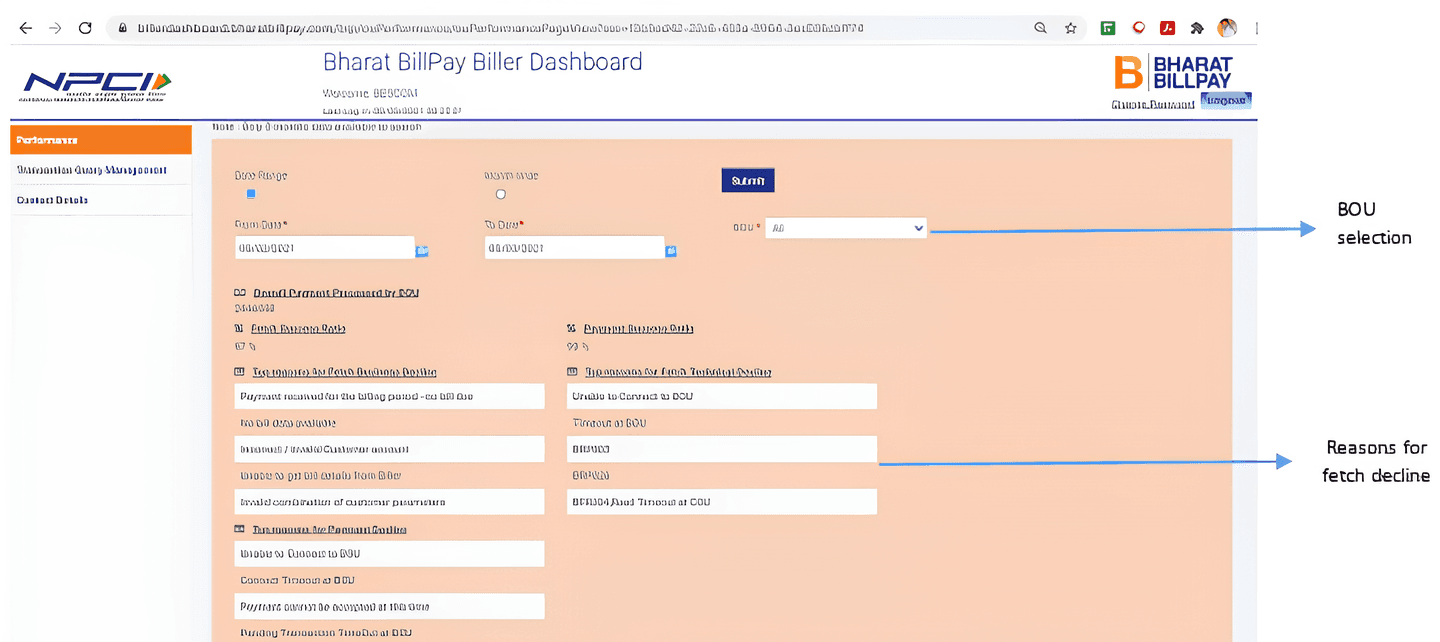

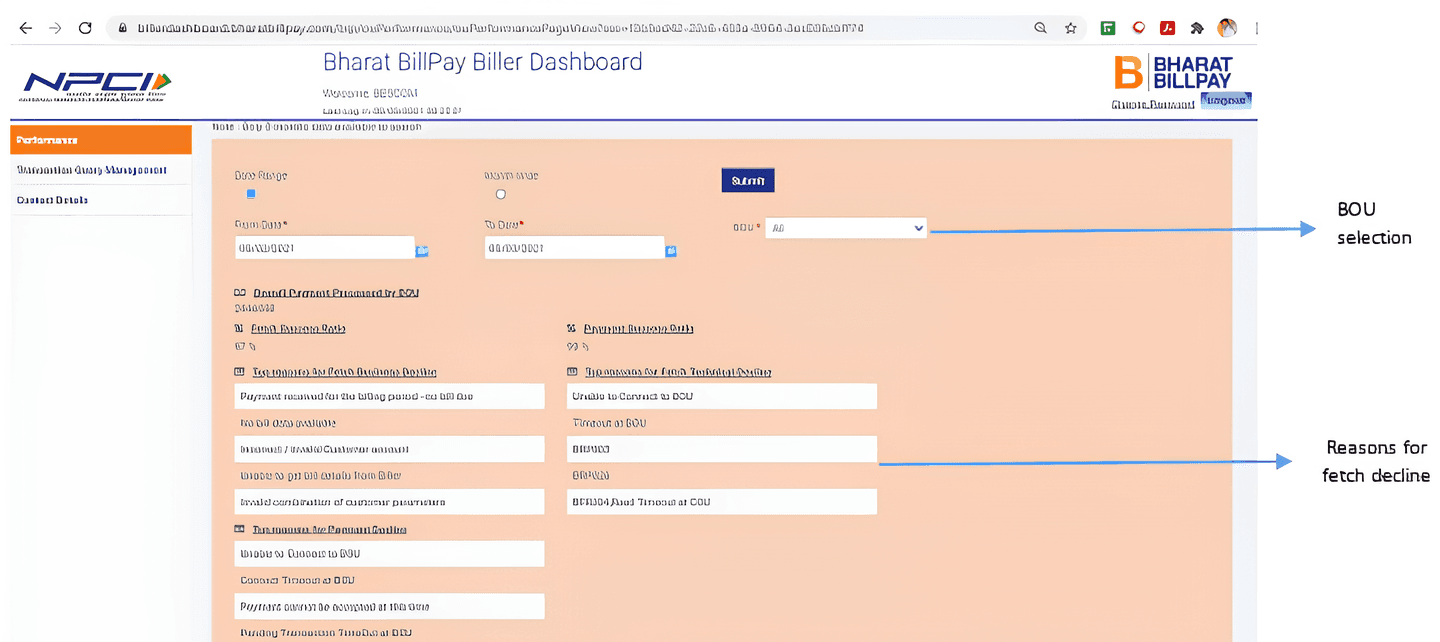

1.3 Not Great for Engagement

1.3 Not Great for Engagement

1.3 Not Great for Engagement

The initial MVP, while functional, frustrates B2B users as it scales up. Poor navigation and design hinder information retrieval. Enhancing structure and design is crucial for improved usability, inter-operations and Iaccessibility.

The initial MVP, while functional, frustrates B2B users as it scales up. Poor navigation and design hinder information retrieval. Enhancing structure and design is crucial for improved usability, inter-operations and Iaccessibility.

The initial MVP, while functional, frustrates B2B users as it scales up. Poor navigation and design hinder information retrieval. Enhancing structure and design is crucial for improved usability, inter-operations and Iaccessibility.

Users at the customer end many times face challenges and frustration when money gets debited from the account using any COU app but bill payment is not done.

Here is the best way possible story of the two banks depicting the problem statement:

Designing for future

Designing for future

Designing for future

Designing for future

2.1 Understanding the target user behavior around dashboard

2.1 Understanding the target user behavior around dashboard

2.1 Understanding the target user behavior around dashboard

2.1 Understanding the target user behavior around dashboard

Target User in this scenario are those billers who regularly track the bill payments to keep the data as well as accounts updated and saved .

Behavioral changes toward dashboards are evolving, driven by technological advancements and a growing emphasis on data-driven decision-making. In the future, we can anticipate several key trends:

Target User in this scenario are those billers who regularly track the bill payments to keep the data as well as accounts updated and saved .

Behavioral changes toward dashboards are evolving, driven by technological advancements and a growing emphasis on data-driven decision-making. In the future, we can anticipate several key trends:

Target User in this scenario are those billers who regularly track the bill payments to keep the data as well as accounts updated and saved .

Behavioral changes toward dashboards are evolving, driven by technological advancements and a growing emphasis on data-driven decision-making. In the future, we can anticipate several key trends:

Target User in this scenario are those billers who regularly track the bill payments to keep the data as well as accounts updated and saved .

Behavioral changes toward dashboards are evolving, driven by technological advancements and a growing emphasis on data-driven decision-making. In the future, we can anticipate several key trends:

I will occasionally look at the dashboard, but I expect clear insights that can become actionables

I will occasionally look at the dashboard, but I expect clear insights that can become actionables

I will occasionally look at the dashboard, but I expect clear insights that can become actionables

Aids troubleshooting

Aids troubleshooting

Aids troubleshooting

Intelligent Analytics

Intelligent Analytics

Intelligent Analytics

Don’t want to interact with age old software

Don’t want to interact with age old software

Don’t want to interact with age old software

Minimal patience

Minimal patience

Minimal patience

Low Latency

Low Latency

Low Latency

2.2 Pain points of the user around existing interface

2.2 Pain points of the user around existing interface

2.2 Pain points of the user around existing interface

Billers wants visibility on a transaction level.

For example, where the transaction has failed so that they know whom to approach.

Customer service becomes tricky.

As visibility is not there, it becomes difficult to answer the customers. Because

customer is awaiting for a refund.

The billers want visibility on the settlement that is happening between COU and

the BOUs.

BOUs sometimes don’t show all the transactions in the MIS they send to the Biller.

Some transactions are absent in the daily MIS and these transactions are sometimes

settled a week later. But we even end up disconnecting the services of the customers,

because we haven’t received the amount.

Common reference ID is needed.

Sometimes customers send screenshots of the app /COU through which they make

the payments. It becomes hard to track the transaction.

Billers wants visibility on a transaction level.

For example, where the transaction has failed so that they know whom to approach.

Customer service becomes tricky.

As visibility is not there, it becomes difficult to answer the customers. Because

customer is awaiting for a refund.

The billers want visibility on the settlement that is happening between COU and

the BOUs.

BOUs sometimes don’t show all the transactions in the MIS they send to the Biller.

Some transactions are absent in the daily MIS and these transactions are sometimes

settled a week later. But we even end up disconnecting the services of the customers,

because we haven’t received the amount.

Common reference ID is needed.

Sometimes customers send screenshots of the app /COU through which they make

the payments. It becomes hard to track the transaction.

Billers wants visibility on a transaction level.

For example, where the transaction has failed so that they know whom to approach.

Customer service becomes tricky.

As visibility is not there, it becomes difficult to answer the customers. Because

customer is awaiting for a refund.

The billers want visibility on the settlement that is happening between COU and

the BOUs.

BOUs sometimes don’t show all the transactions in the MIS they send to the Biller.

Some transactions are absent in the daily MIS and these transactions are sometimes

settled a week later. But we even end up disconnecting the services of the customers,

because we haven’t received the amount.

Common reference ID is needed.

Sometimes customers send screenshots of the app /COU through which they make

the payments. It becomes hard to track the transaction.

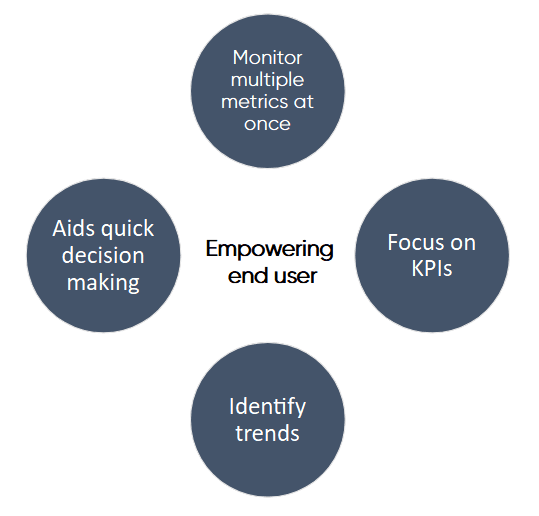

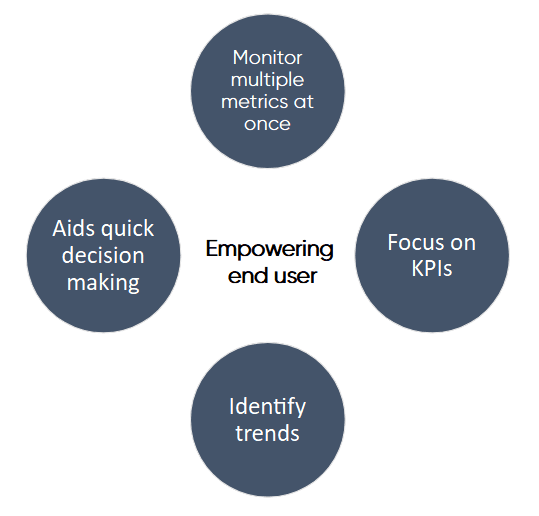

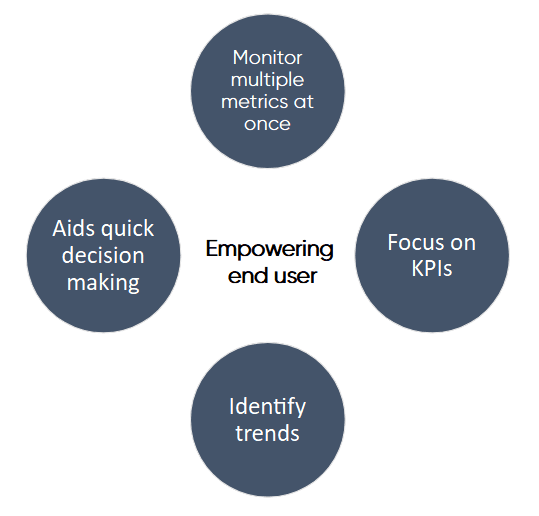

2.3 Why Dashboard

2.3 Why Dashboard

2.3 Why Dashboard

Dashboards consolidate data visually, aiding quick decision-making by displaying multiple metrics in real-time. Prioritizing KPIs, they offer customizable views for users, fostering data-driven insights.

Dashboards consolidate data visually, aiding quick decision-making by displaying multiple metrics in real-time. Prioritizing KPIs, they offer customizable views for users, fostering data-driven insights.

Dashboards consolidate data visually, aiding quick decision-making by displaying multiple metrics in real-time. Prioritizing KPIs, they offer customizable views for users, fostering data-driven insights.

2.4 Key findings about user tasks around dashboard usage

2.4 Key findings about user tasks around dashboard usage

2.4 Key findings about user tasks around dashboard usage

Key task is to check the reason of failure whether it is technical failure or customer end failure.

Monitor daily transaction and settlement volumes.

Easily search and identify failed transactions, including reasons and specific failure levels.

Track refund status for unsuccessful transactions.

Access settlement details, including BBPS BOU settlement file.

Evaluate BOUs performance: volume, value, successful/failed transactions, uptime, downtime.

Analyze data based on preferred payment modes and channels.

Seek insights from the analysis for informed decision-making.

Generate comprehensive reports for higher management sharing, emphasizing data-driven insights.

Key task is to check the reason of failure whether it is technical failure or customer end failure.

Monitor daily transaction and settlement volumes.

Easily search and identify failed transactions, including reasons and specific failure levels.

Track refund status for unsuccessful transactions.

Access settlement details, including BBPS BOU settlement file.

Evaluate BOUs performance: volume, value, successful/failed transactions, uptime, downtime.

Analyze data based on preferred payment modes and channels.

Seek insights from the analysis for informed decision-making.

Generate comprehensive reports for higher management sharing, emphasizing data-driven insights.

Key task is to check the reason of failure whether it is technical failure or customer end failure.

Monitor daily transaction and settlement volumes.

Easily search and identify failed transactions, including reasons and specific failure levels.

Track refund status for unsuccessful transactions.

Access settlement details, including BBPS BOU settlement file.

Evaluate BOUs performance: volume, value, successful/failed transactions, uptime, downtime.

Analyze data based on preferred payment modes and channels.

Seek insights from the analysis for informed decision-making.

Generate comprehensive reports for higher management sharing, emphasizing data-driven insights.

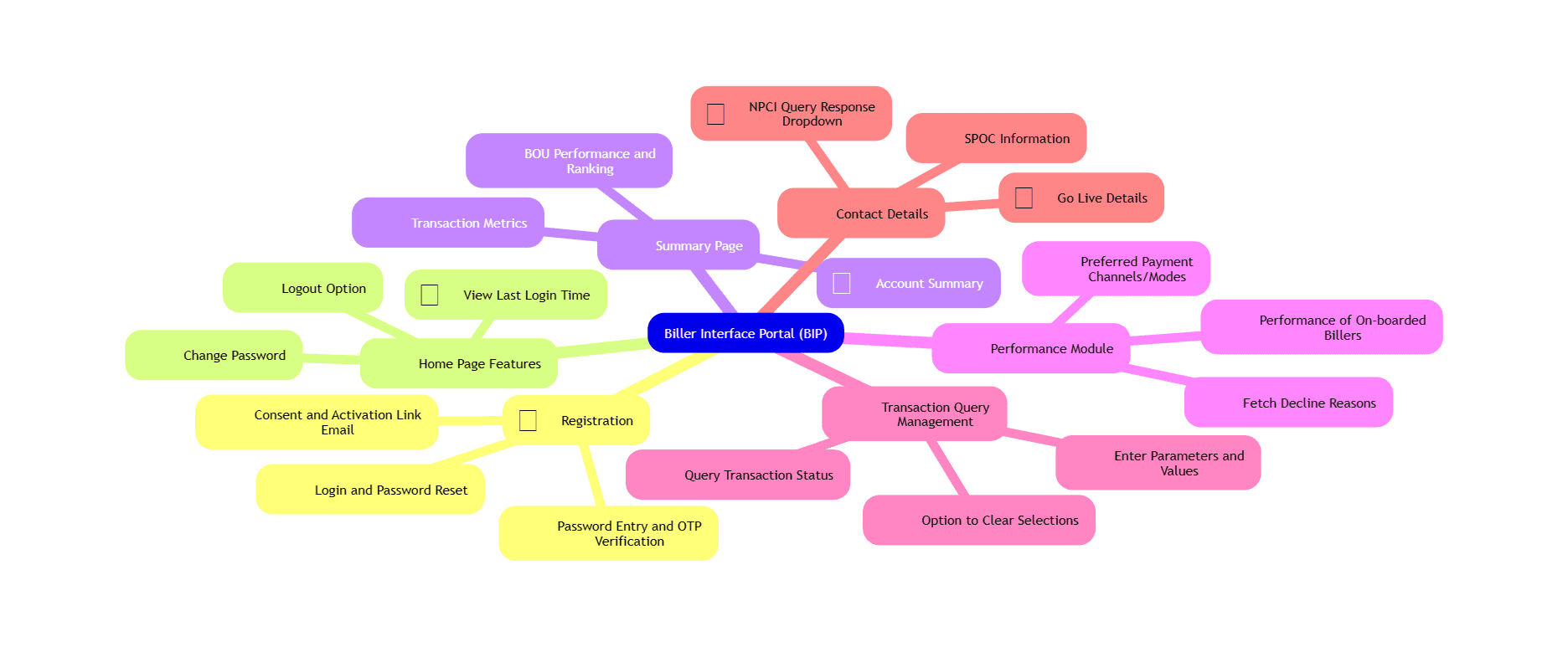

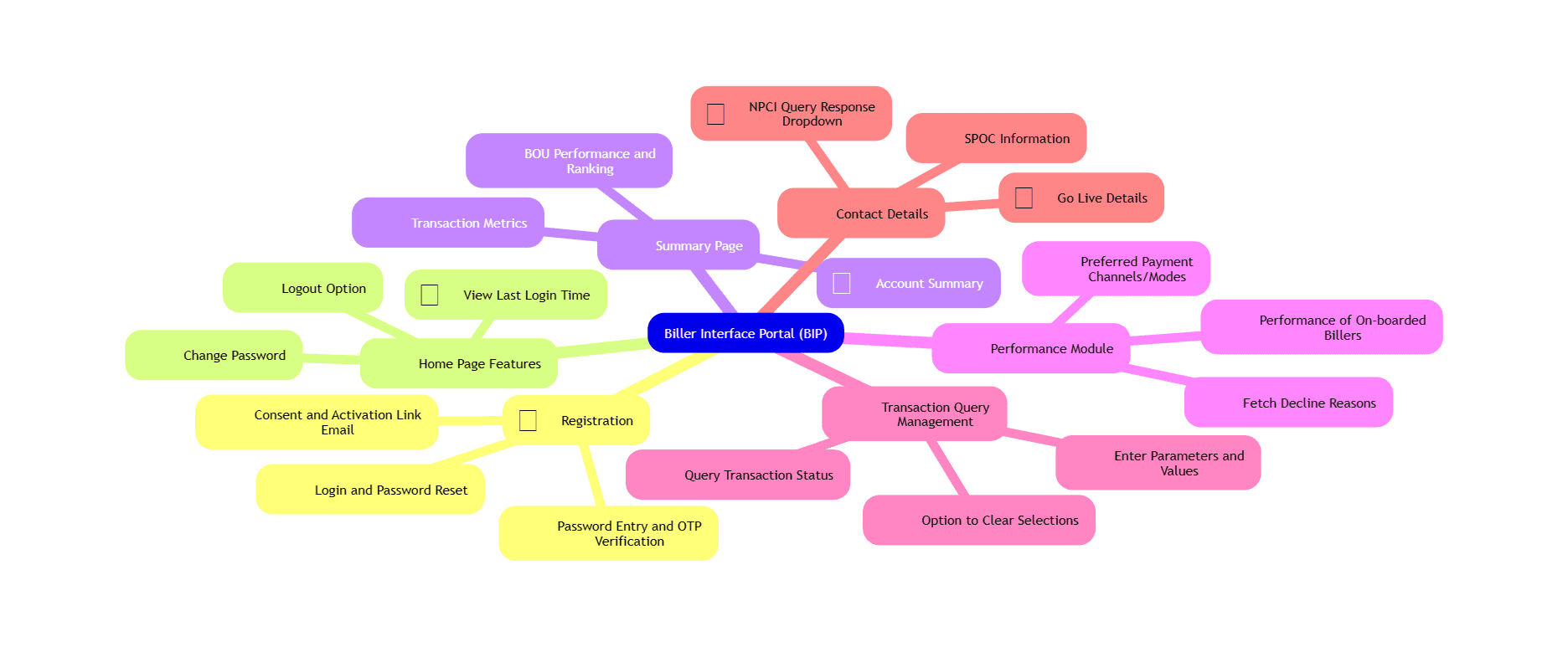

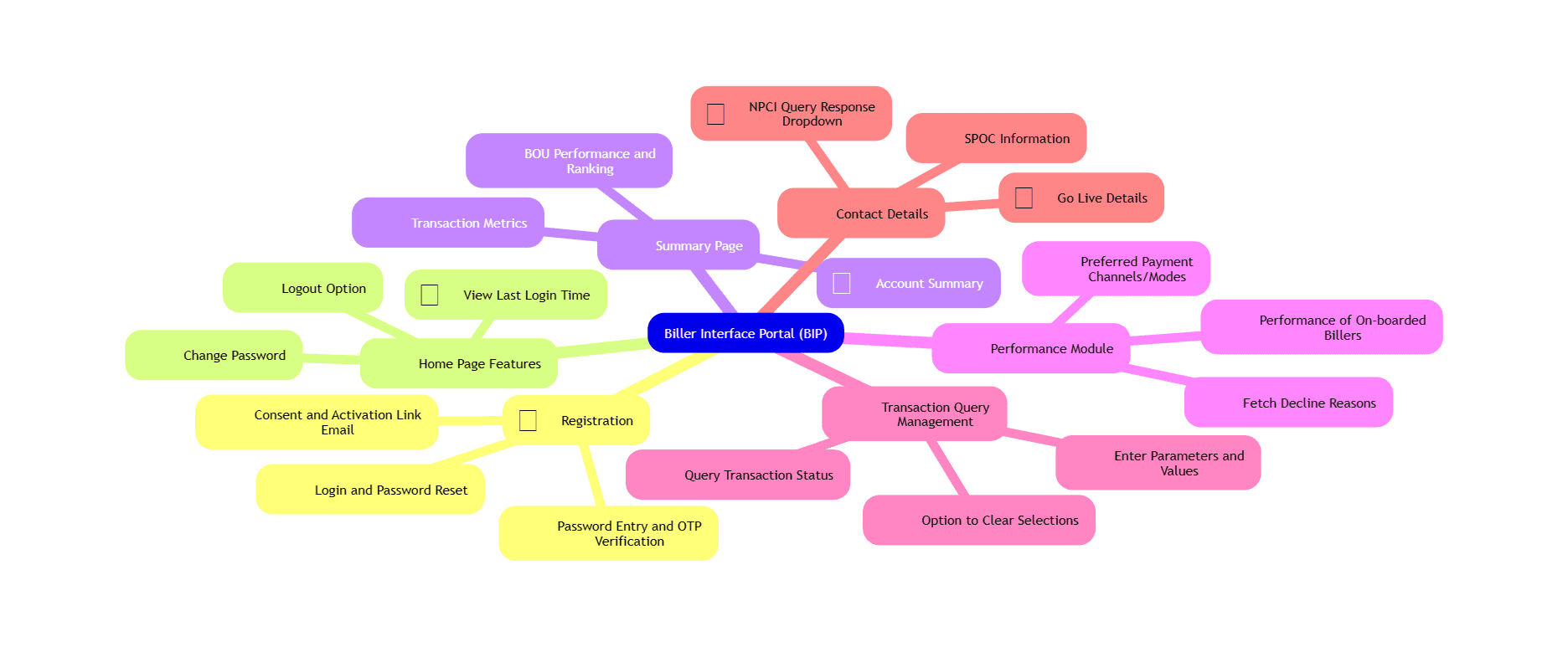

Work flow diagram(BRD)

Work flow diagram(BRD)

Work flow diagram(BRD)

Work flow diagram(BRD)

Glimpse of structure design

Glimpse of structure design

Glimpse of structure design

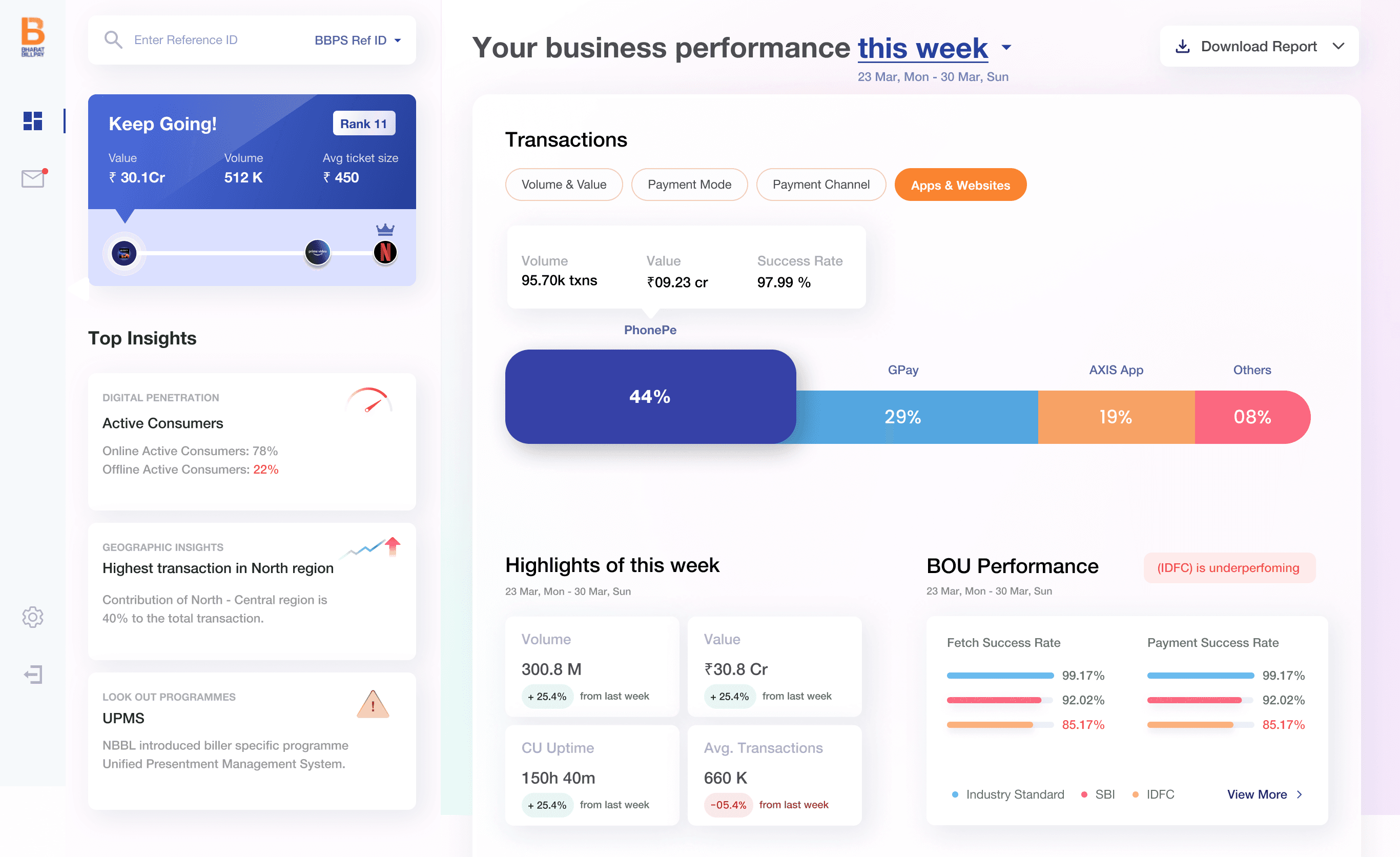

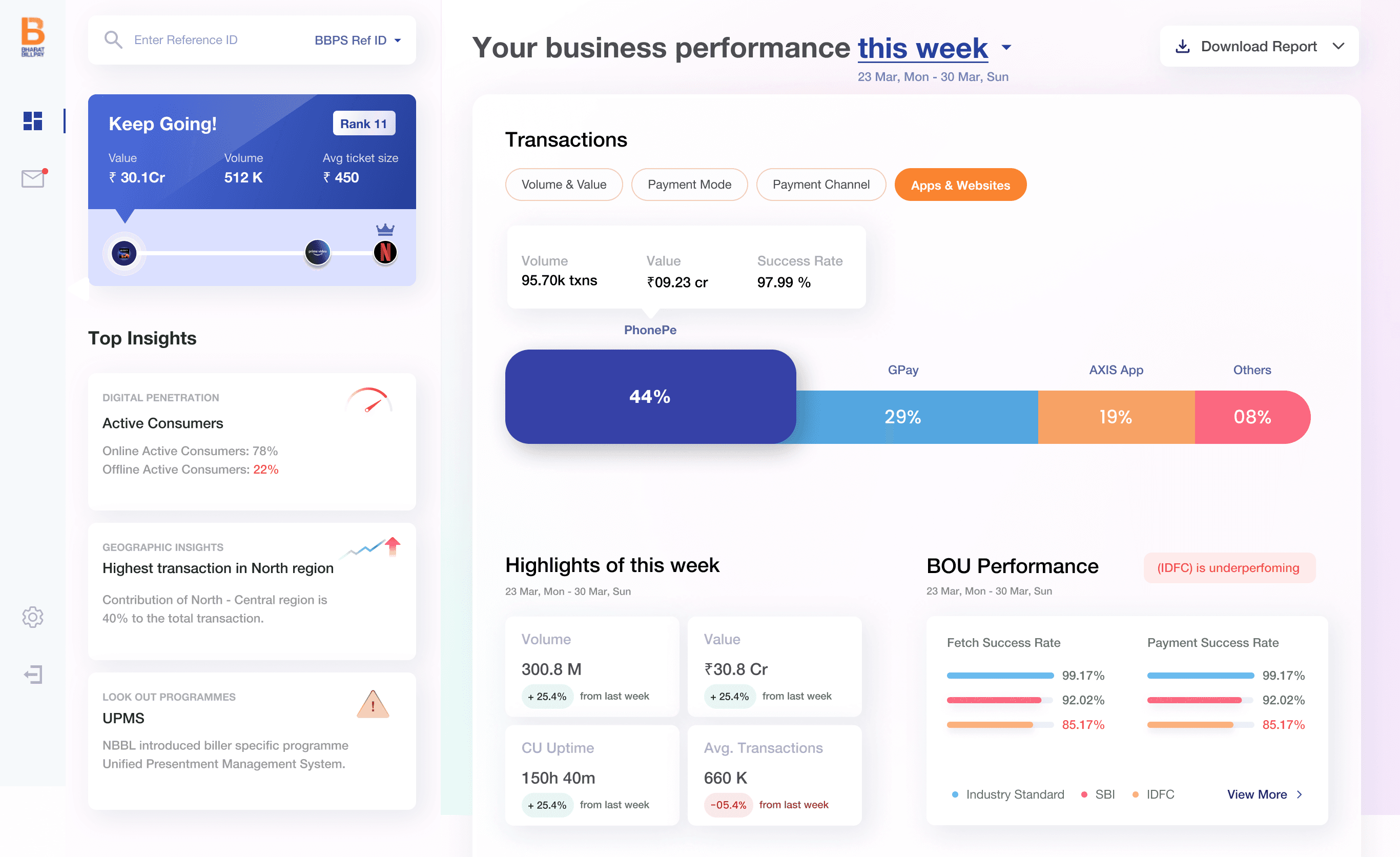

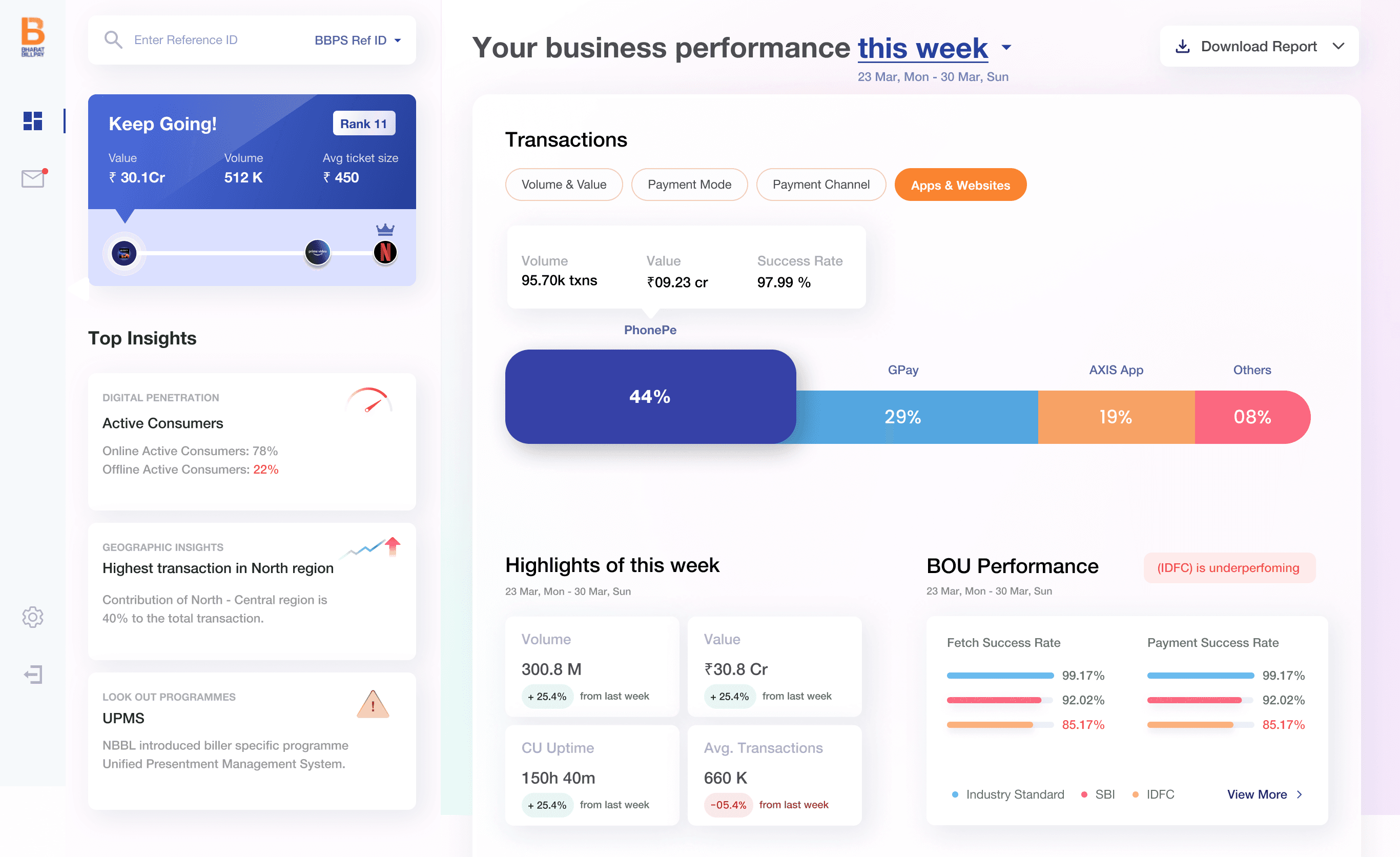

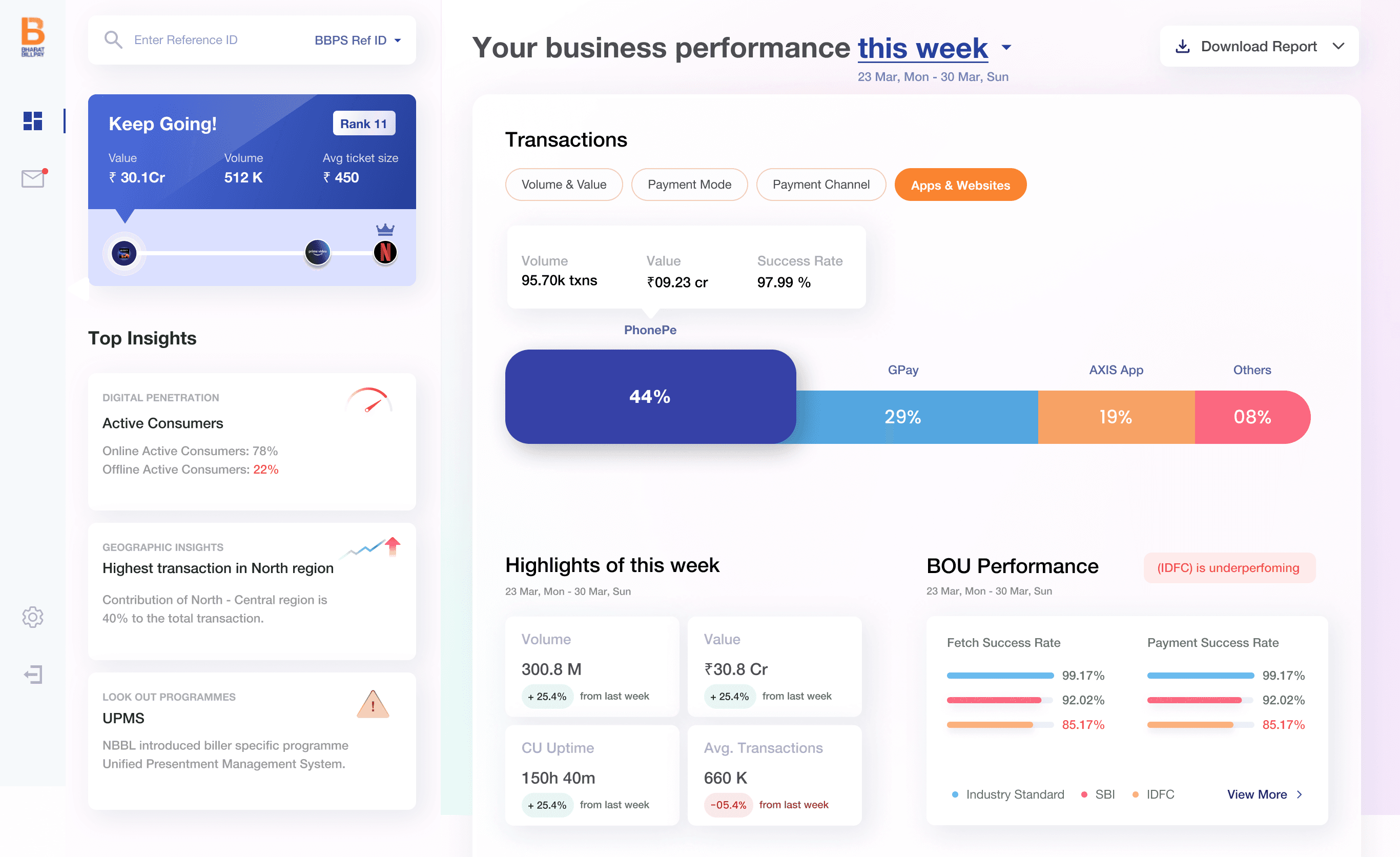

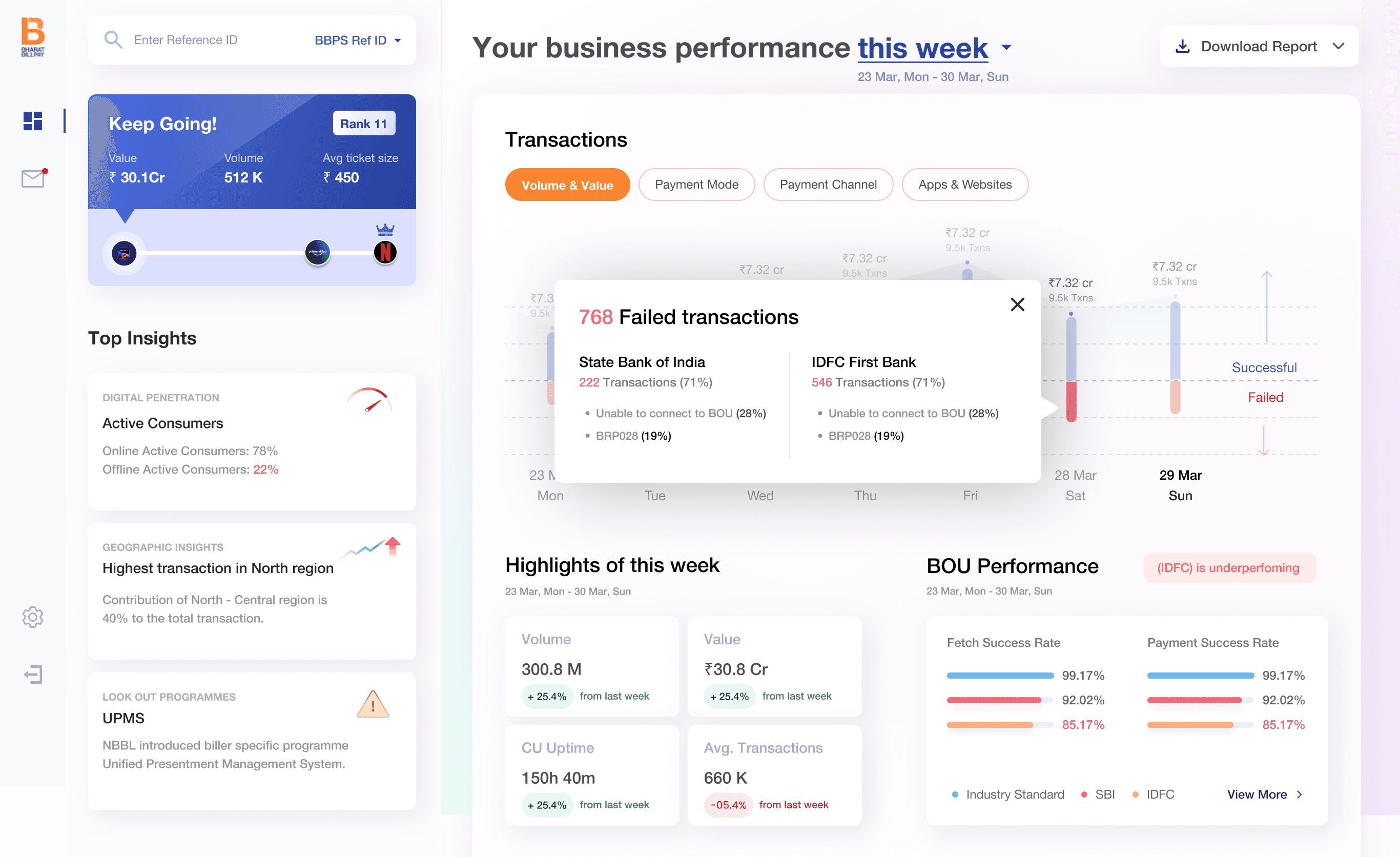

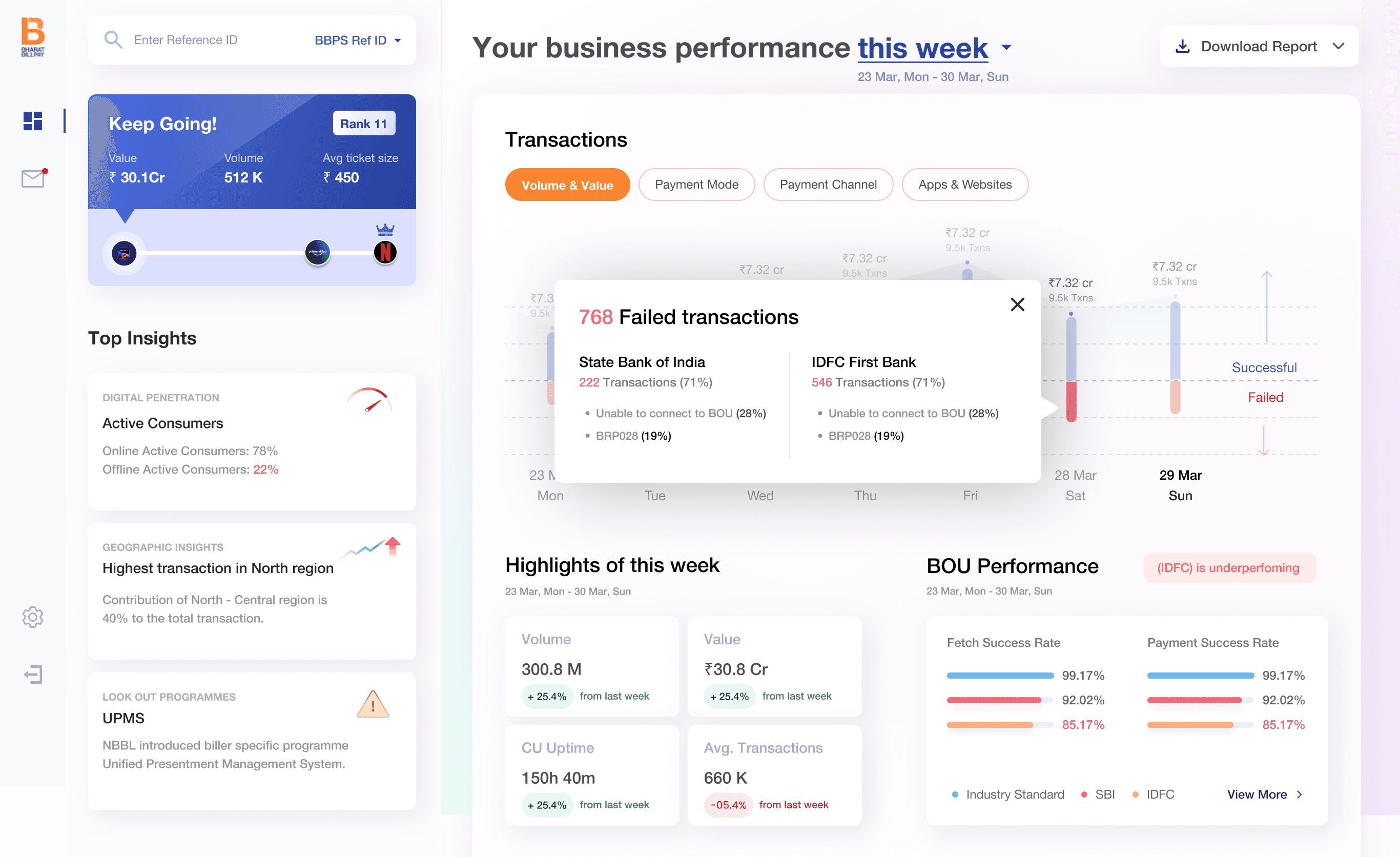

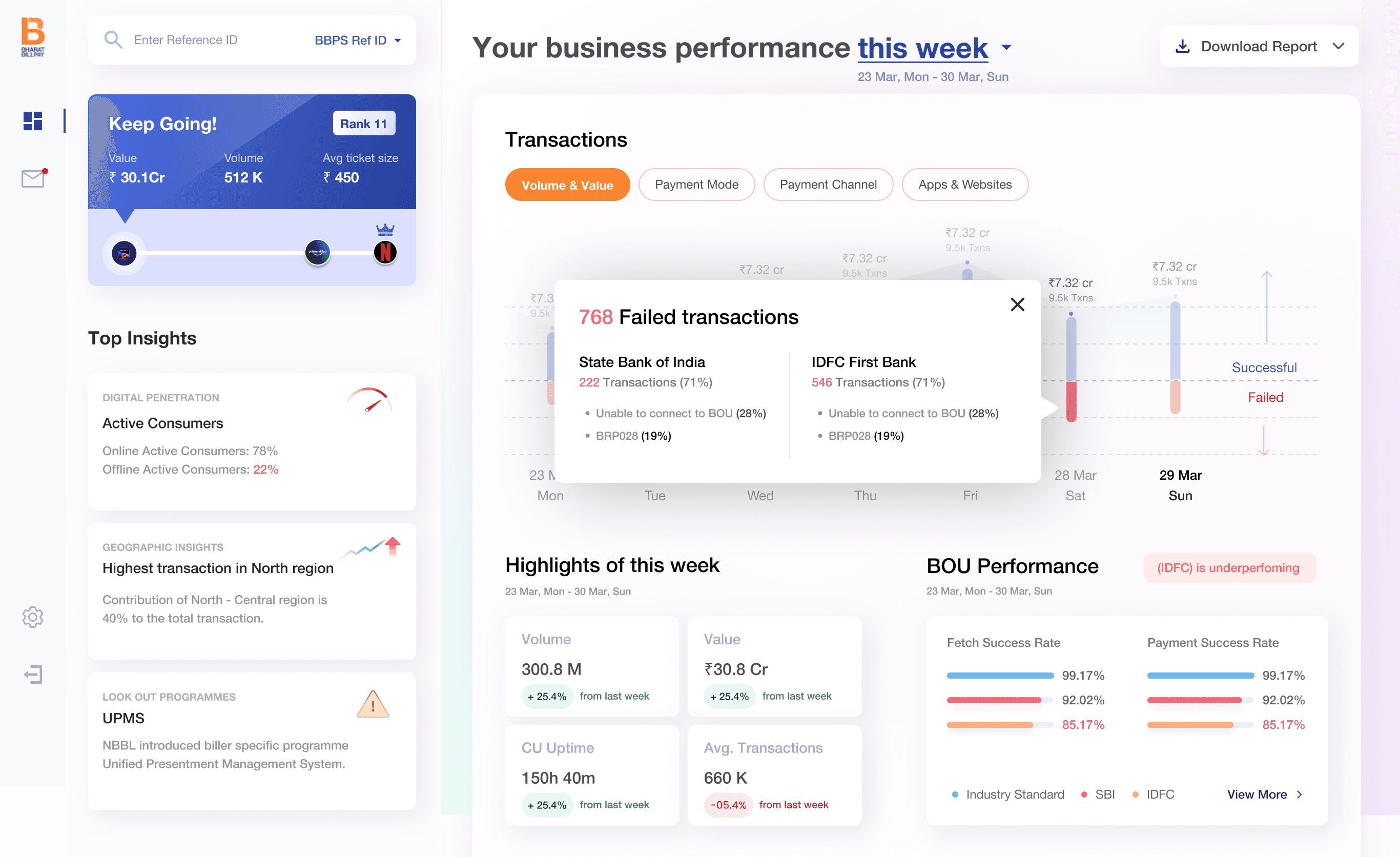

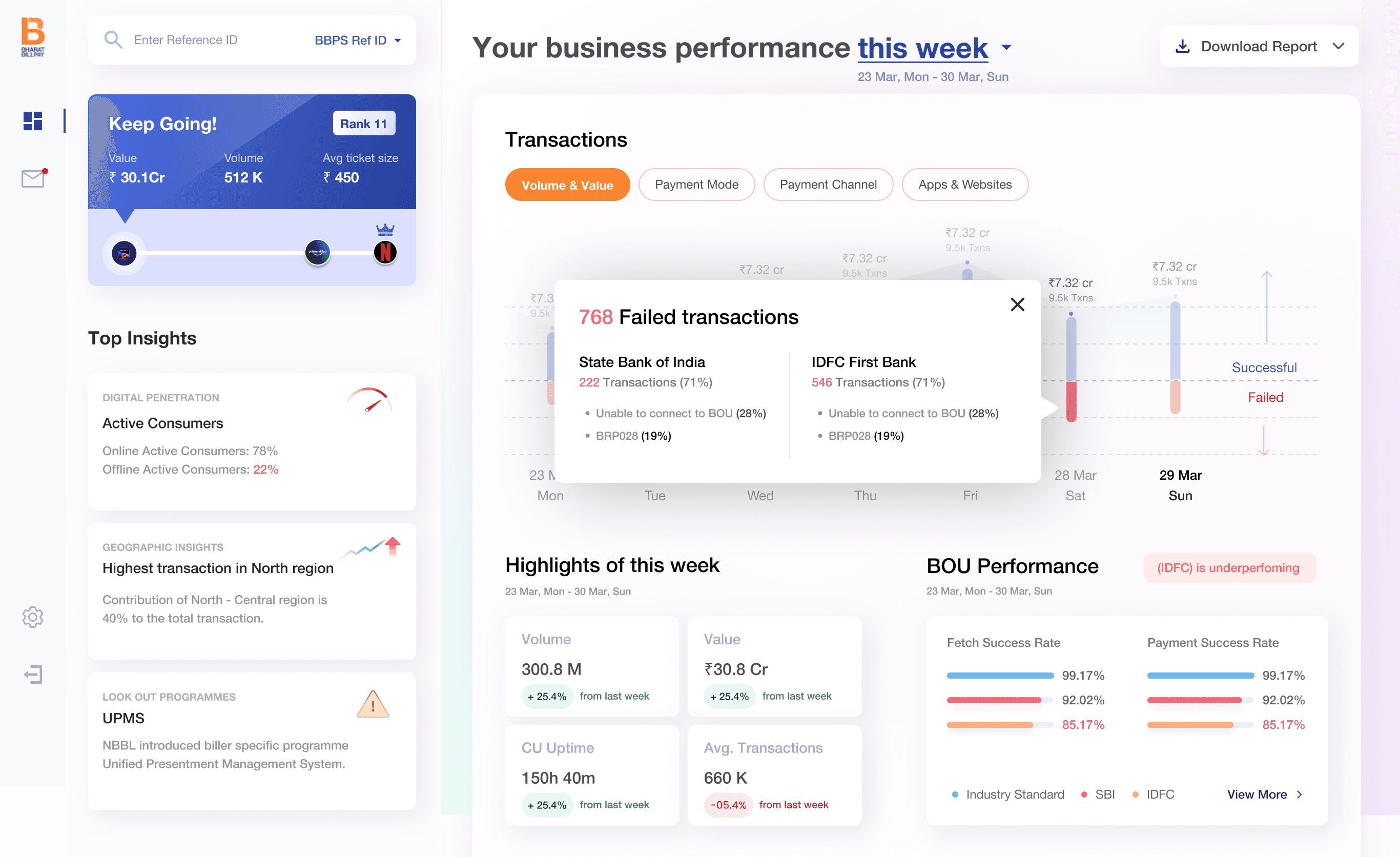

Key task is to check the reason of failure whether it is technical failure or customer end failure.(User task)

Key task is to check the reason of failure whether it is technical failure or customer end failure.(User task)

Key task is to check the reason of failure whether it is technical failure or customer end failure.(User task)

The dashboard addresses the user's need to understand transaction failure reasons by visually presenting data insights. Through charts and interactive features, it offers a quick overview and detailed analysis, empowering users to efficiently identify patterns and take proactive measures for improved transaction success rates.

The dashboard addresses the user's need to understand transaction failure reasons by visually presenting data insights. Through charts and interactive features, it offers a quick overview and detailed analysis, empowering users to efficiently identify patterns and take proactive measures for improved transaction success rates.

The dashboard addresses the user's need to understand transaction failure reasons by visually presenting data insights. Through charts and interactive features, it offers a quick overview and detailed analysis, empowering users to efficiently identify patterns and take proactive measures for improved transaction success rates.

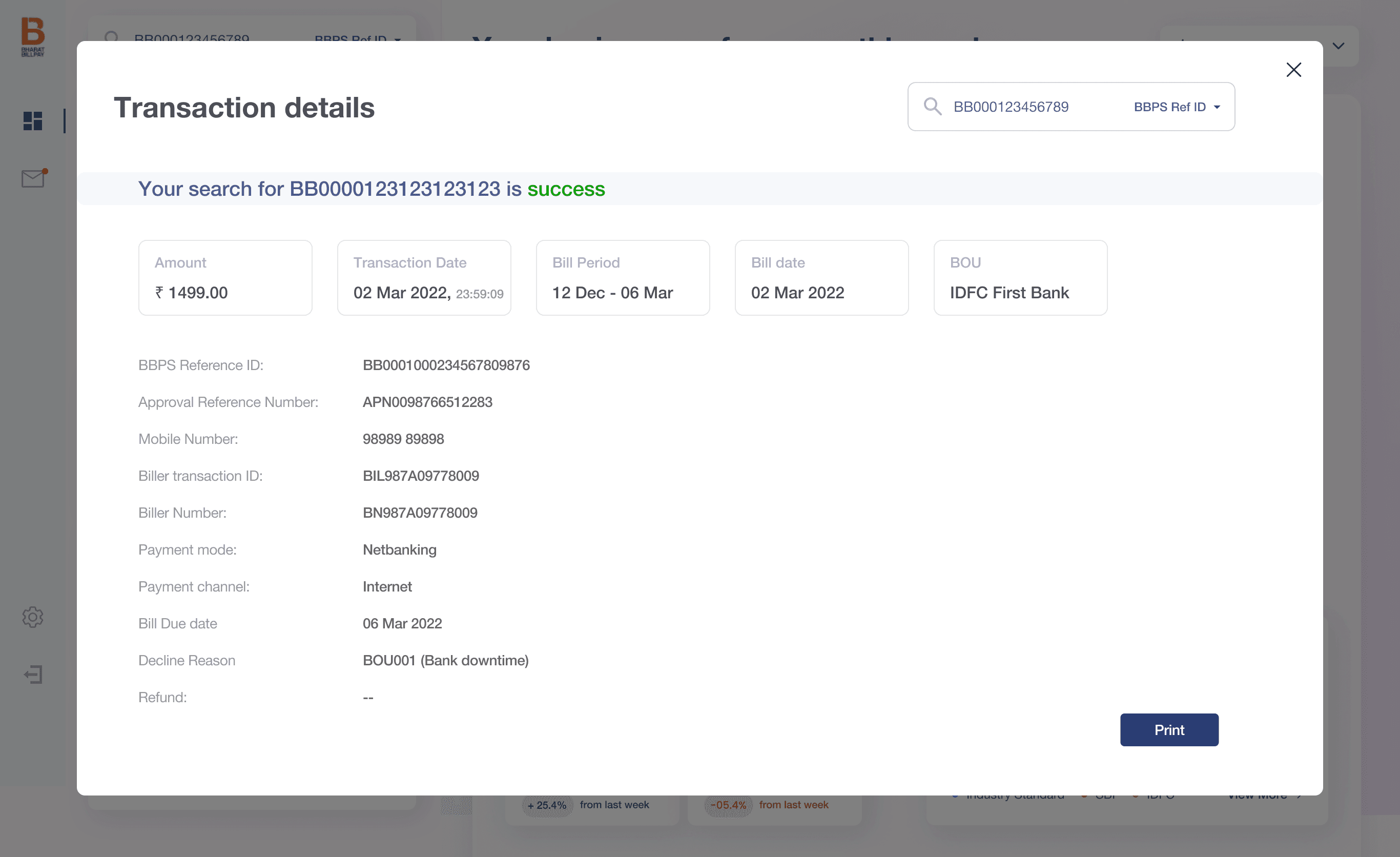

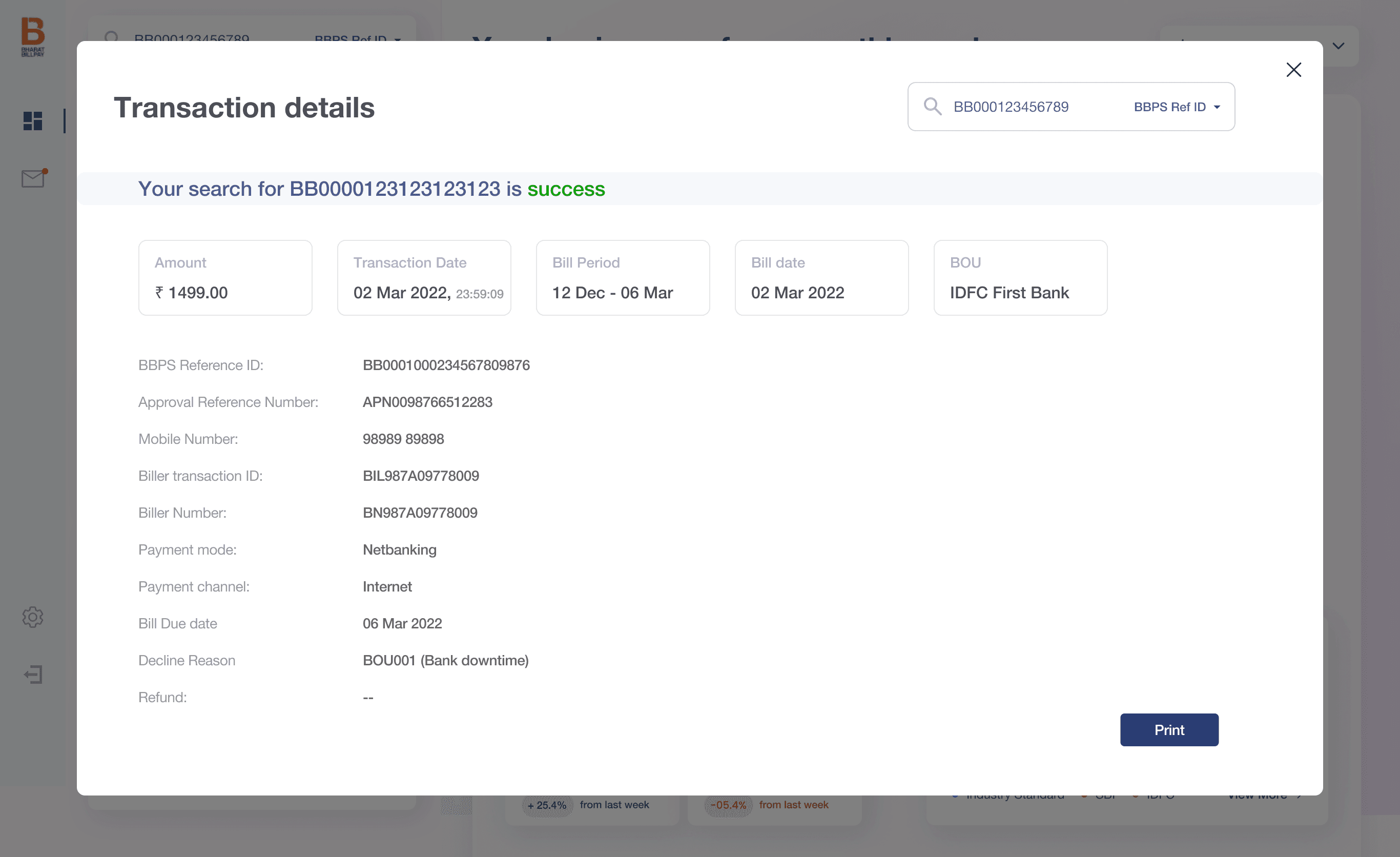

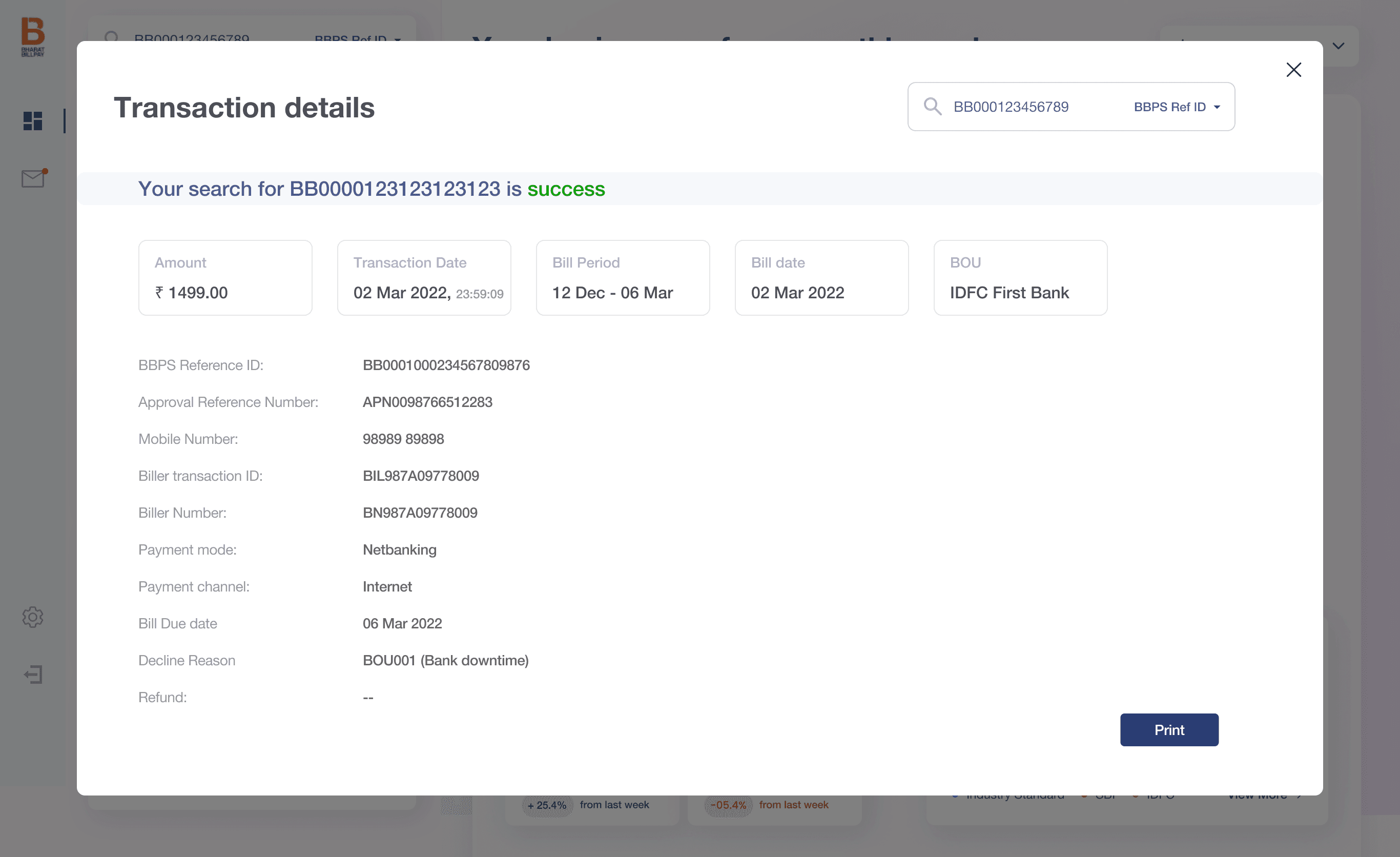

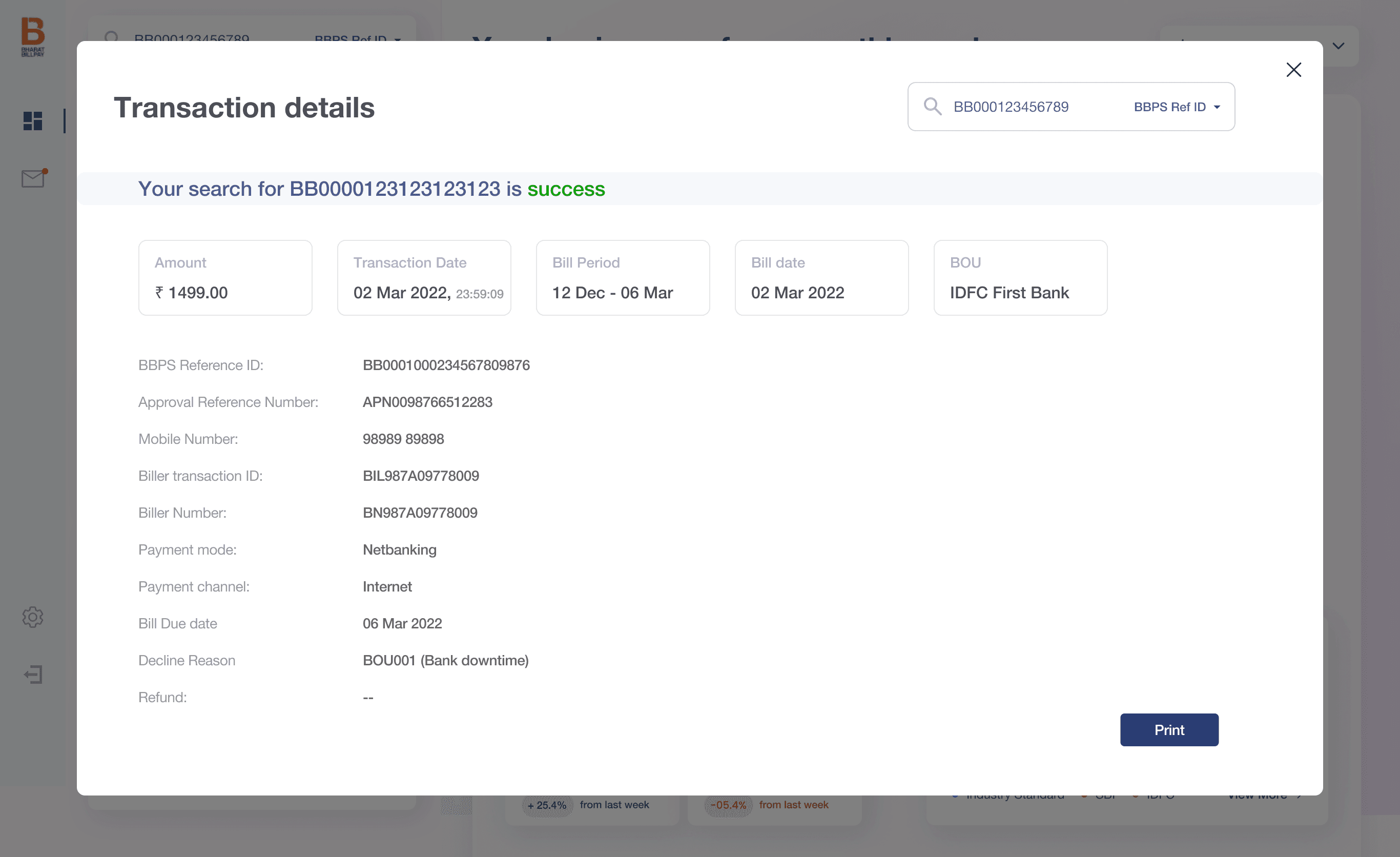

Search result is optimized understanding the user behavior around Key parameters.

Search result is optimized understanding the user behavior around Key parameters.

Search result is optimized understanding the user behavior around Key parameters.

Optimized search results are achieved by comprehensively understanding user behavior related to key parameters. This involves analyzing how users interact with the search feature, emphasizing KPIs that are most relevant to them. By tailoring search algorithms to prioritize user-centric KPIs, the system delivers more accurate and personalized results, enhancing the overall search experience.

**connect to know more in detail.,

Optimized search results are achieved by comprehensively understanding user behavior related to key parameters. This involves analyzing how users interact with the search feature, emphasizing KPIs that are most relevant to them. By tailoring search algorithms to prioritize user-centric KPIs, the system delivers more accurate and personalized results, enhancing the overall search experience.

**connect to know more in detail.,

Optimized search results are achieved by comprehensively understanding user behavior related to key parameters. This involves analyzing how users interact with the search feature, emphasizing KPIs that are most relevant to them. By tailoring search algorithms to prioritize user-centric KPIs, the system delivers more accurate and personalized results, enhancing the overall search experience.

**connect to know more in detail.,